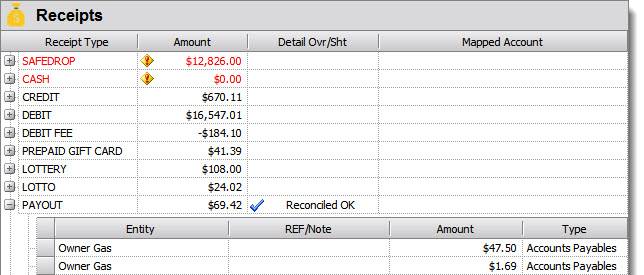

This is all your monies for the day to be allocated for the sales. You can edit the #’s from the POS as needed. Again, for each change you make the system will prompt you to include a reason for the alteration. It is important for tracking reasons to include a reason. Pictured below you will see alert symbols next to RED text. This is showing you that these sections were altered. Before existing the Daily Recon window be sure to click the SAVE icon at the top of the window, otherwise the changes you made will not be applied.

SAFEDROP: The cumulative account of CASH on hand at the time of when the EOD is pulled from the POS.

CREDIT: Transactions ran using credit card

DEBIT: Transactions ran using debit card

DEBIT FEE: The cumulative cost for the day to run debit cards – (will always be a negative number)

PREPAID GIFT CARD: Transactions ran using prepaid cards

LOTTERY: Scratcher-win PAYOUT

LOTTO: Non-Scratcher-win PAYOUT

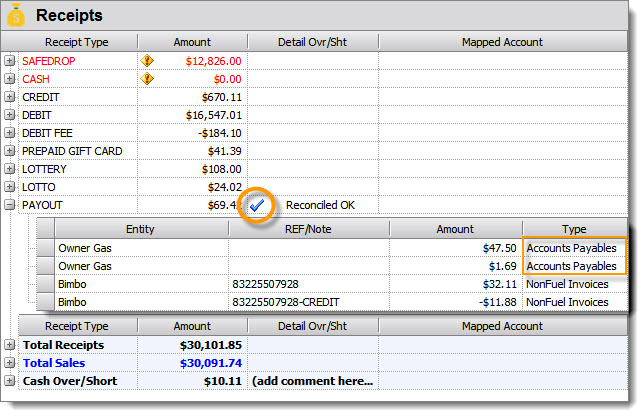

PAYOUT: On-site payments made in CASH– this amount needs to be reconciled. If it’s a salable inventory item then reconcile by attaching a non-fuel invoice (use the PAYOUT option in the invoice header) OR, if it’s a site expense (ex. Landscaper) you can reconcile the amount by attaching an Accounts Payable (A/P) details list.

TOTAL RECEIPTS: All register processed actions. The TOTAL RECEPITS amount is equal to the SAFEDROP + CREDIT + DEBIT – DEBIT FEES + PREPAID GIFT CARDS + LOTTERY + LOTTO + CASH PAYOUTS.

TOTAL SALES: A combination of Fuel Sales and C-Store Sales

CASH/OVERSHORT: The difference between TOTAL RECEIPTS AND TOTAL SALES. You want this number to be as close to $0.00 as possible. If the number is positive then it’s EXTRA (unaccounted for) CASH on site. If the number is negative then it’s LESS THAN the amount of CASH you should have on site. This number can fluctuate based on a variety of factors. To reconcile to $0.00 you would need to investigate your total sales for the day using the reports available to you on S2K and on your POS system. At times this over/short may reflect in the next day or previous day’s Recon depending on the last drop before or after the automated EOD drop.

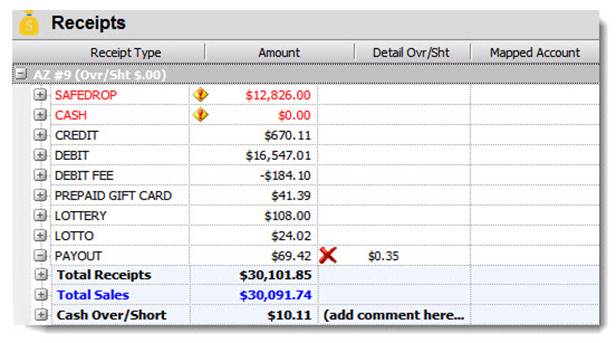

Reconcile PAYOUT Receipt Detail

When reconciling your EOD report you will need to attach A/P or Non-Fuel Invoice PAYOUT details to account for the CASH used for the days store expenses. When the PAYOUT receipt type is not balanced there will be a red “X” in the Detail Over/Short field (pictured below).

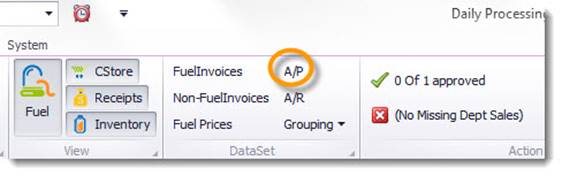

Reconcile PAYOUTS Using Accounts Payable (A/P):

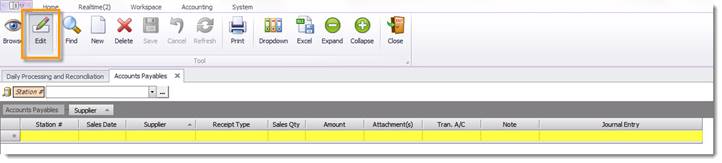

Click the A/P button in the Daily Recon toolbar (pictured below).

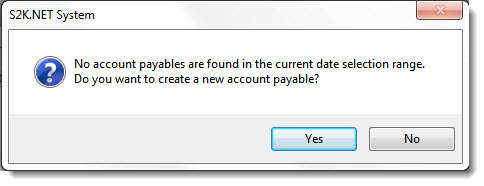

A window will pop up (pictured below) informing you that there aren’t any account payables found for the day. The window will give you the option to create a new account payable. Click YES.

The Accounts Payable window will open. If the page isn’t already defaulted to EDIT, click the edit icon in the tool bar (shown in the picture below). Then you will want to enter information into the area highlighted below.

Enter your STATION # (it should be provided for you to click on).

Enter the SALES DATE, this date should be the same day as the date of the DAILY RECON you need the A/P to reflect in.

Pick from your list of SUPPLIERS (If you have not already created a supplier for you’re A/P section you will want to go back to your home screen, in Daily Books, click on the customer and supplier icon, click the supplier link and add a new supplier. SAVE the new data, go back to the A/P section and REFRESH so that your new supplier appears. For help adding suppliers see the ADDING SUPPLIER section in the ONLINE MANUAL).

In Receipt Type you should be given the option to click PAYOUT.

Enter the AMOUNT of cash from the register that was used to pay this supplier.

If you have a receipt or invoice you want to attach to this particular payout add it to the ATTACHMENT(S) section.

Once you’ve entered the information into the field click the SAVE icon in the toolbar.

After you’ve entered all of the day’s A/P’s click SAVE, then click back to your Daily Recon page. You will need to click REFRESH in order for the PAYOUT numbers to reflect in your receipt section (pictured below).

The A/P (Accounts Payable) will create detail notes of the cash expenses for the site.

You may need to also tie you an invoice to the PAYOUT section to completely reconcile the PAYOUT section. In the invoice header you are given the option to click PAYOUT as a way of payment. Make sure that the invoice day is the same as the recon day or it will generate the PAYOUT for the wrong day.

A completely reconciled PAYOUT section will look like the picture below. When the linked A/P’s and the linked invoices match the amount polled from the POS then you will see a blue check mark and RECONCILED OK in the Detail Over/Short section (pictured below)