Setting up S2k to integrate with QuickBooks

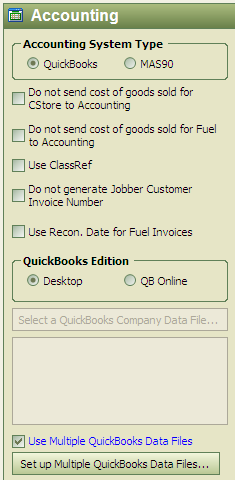

Before you setup QB you must set the standard settings as shown below:

Key:

Accounting System Type: Select QuickBooks, Mas90 is handled separately

Do not send COGS for C-Store to Accounting: When we send over C-Store sales transactions to QB, will only send sales, not inventory reduction or COG INCREASE. Will show a 100% profit in QB for C-Store sales.

Do not send COGS for Fuel to Accounting: When we send over Fuel sales transactions to QB, will only send sales, not inventory reduction or COG INCREASE. Will show a 100% profit in QB for Fuel Sales.

Use ClassRef: If running multiple stores, this box should be checked, station ID used in QB or can be synced to an existing Class ref in QB. Very simple to use, please review this screen:

Do not generate Jobber Customer Inv. #: For Jobbers only

Use Recon Date for Fuel Invoices: Currently for BP use Only- will use delivery (recon) date on fuel invoices since BP invoices may be dated a couple days after delivery.

QuickBooks Edition: Desktop or QB Online: S2k can communicate with the following QB systems:

1) QuickBooks desktop versions (2005 and later excluding QB Standard and Canadian versions)

2) Multiple Desktop QuickBooks

3) QB on line version.

Use Multiple QB Database files: S2k can communicate with more that one local QB database, this however is a very complex procedure and should only be done when S2k tech department approves your setup.