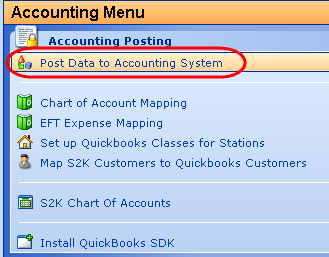

Accounting Posting

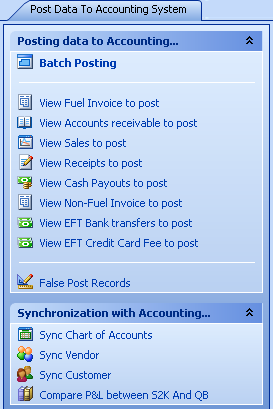

Post Data to Accounting System

To do this, go to the Accounting menu and select ‘Post Data to Accounting System’. **Make sure you have QuickBooks open if you are using the desktop version (not QuickBooks online). Data will not post if the program is not open and running.

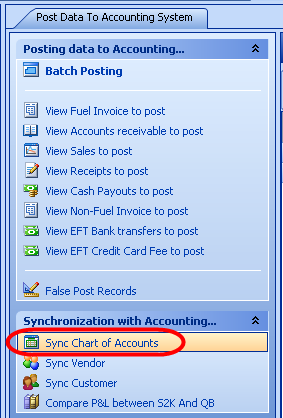

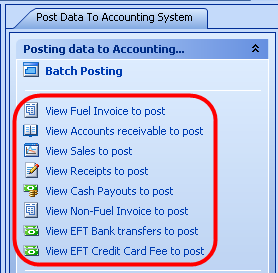

Click on the type of data you would like to post to QuickBooks.

Data to post includes:

Fuel Invoices

Accounts Receivable

Sales

Receipts

Cash Payouts

EDI and Palm

EFT Bank Transfers

EFT Credit Card Fees

Non-Fuel Fees & Invoices (if included from Oil Company)

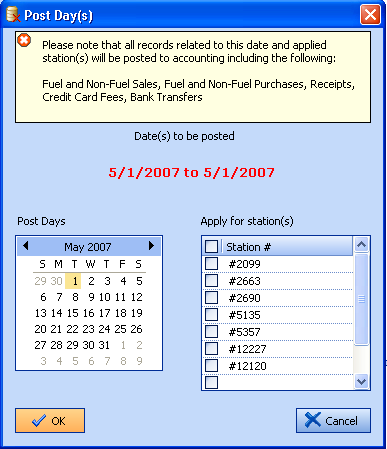

This will post all transactions for the dates you select on the calendar below (click and drag to select date range). You can post for any sites you select in the box to the right of the calendar. Once you have made these selections, simply click “OK”.

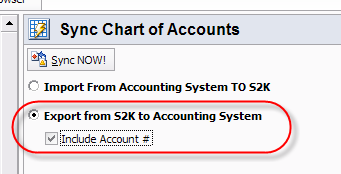

To Sync Chart of Accounts, from the Accounting Menu, go to “Post Data to Accounting System”, then “Sync Chart of Accounts”.

Select how you want to sync the data, either from QB to S2k or from S2k to QB, then click “Sync NOW!” If you already have an existing QB Chart of Accounts use the 2nd option “Export from S2k to Accounting System” as S2k already has the Chart of Accounts setup with numbers:

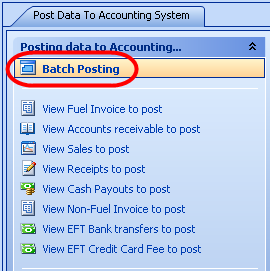

Posting One Type of Transaction

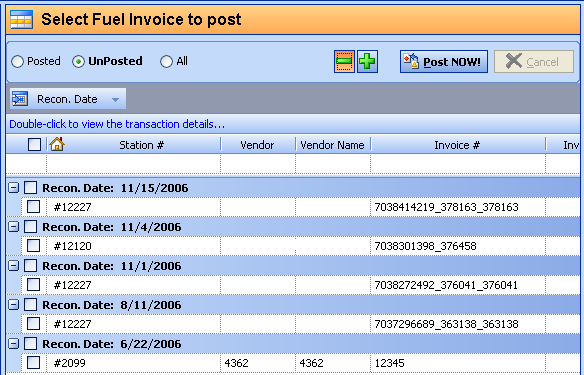

You have options of which records you wish to post. The list of different data is shown below.

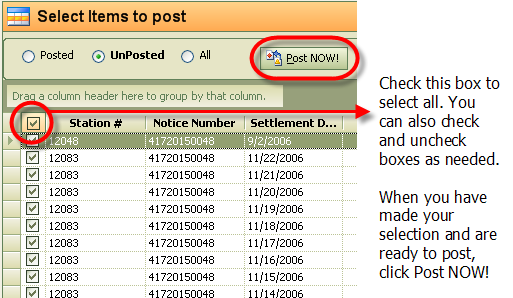

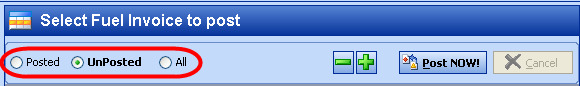

First select the type of data you would like to post, then, select if you want to view posted or unposted records.

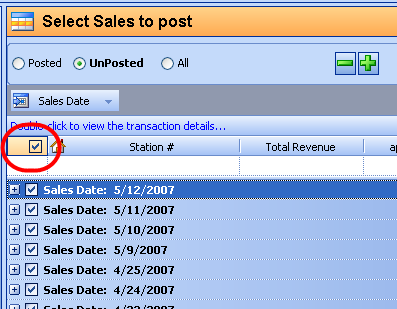

Next, select further which records you would like to post by checking the box next to the record. Click on the ‘+’ sign in order to view the records under each date. Or you can click on the big green minus icon above to expand all records as shown below.

To

select all the boxes, click on the box indicated above.

Once you have made your selections, click “Post NOW!”.

When Posting Data & RE-Posting

Data: READ THIS FIRST

When Posting Data & RE-Posting

Data: READ THIS FIRST