Fuel Inventory Adjustments in QuickBooks

This adjustment should be made once a month for temperature correction. Be sure to check for missing fuel invoices between S2k and QB and that all stick readings are balanced.

There are reports in S2k to check these. Go to REPORTS> FUEL INVENTORY> FUEL INVENTORY DAILY REPORT. Run for the month and check over/shorts for missing invoices or misdated invoices. If you want you can adjust the RECON date on the Fuel invoice to make sure it applies to the correct daily. The total at the bottom of this report should be fairly close to your adjustment. If it is not close, check for duplicates etc.. in QB. You can also try to repost ONLY SALES for the month to see if that helps. If you posted to QB and added invoices after you posted, your COGS may be inaccurate and reposting sales will correct that.

THEN, once you are certain you are not missing anything...

1- In QB, Create a Balance Sheet for ending of a specific month you want to adjust, EX: July 31, 2007:

2- Generate a report in S2K under REPORTS> FUEL INVENTORY> DOLLARS ON HAND for that closing day (for example July 31) These are your CORRECT Inventory totals by grade.

3- Then make a GL entry in QuickBooks to adjust to correct levels using the Inventory- Fuel and COGs- Fuel accounts by GRADE in QuickBooks.

EXAMPLE: JULY 31, 2007 QB BALANCE SHEET SAYS INVENTORY LEVEL FOR UNLEADED FUEL WAS $7833.21, S2K SHOWS CLOSING STICKS FOR UNLEADED VALUED AT $14600.59 (5823GALLONS X $2.5074 COST PER GALLON).

SO INVENTORY IS SHORT BY $6767.38.

YOU MUST DEBIT INVENTORY-UNLEADED AND CREDIT COGS-UNLEADED $6767.38 TO GET IT TO BE $14600.59.

YOU MUST DO THIS ADJUSTMENT EACH MONTH TO CORRECT OVER/SHORT, ETC IN FUEL INVENTORIES/COGS ACCOUNTS.

Sending Other Charges to QuickBooks

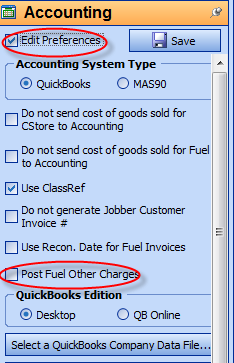

S2k does NOT automatically send these charges to QuickBooks, so if you want to send these charges to QuickBooks go to Accounting and click on Edit Preferences and select the check box as shown below:

Once that button is selected AND saved the data will now go to QuickBooks as mapped.