QuickBooks: Other Charges on Fuel Invoices

QuickBooks: Setting Up Other Charges on Fuel Invoices

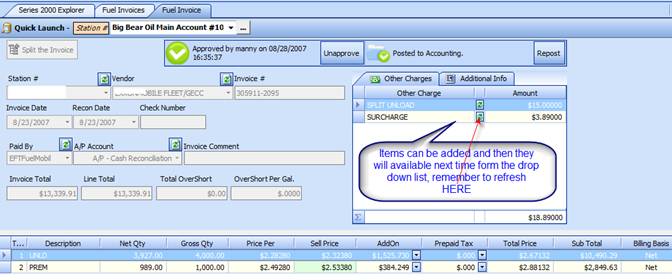

S2k has the ability to add other charges as opposed to regular add-ons into an invoice. This feature was built into S2k really for the jobber portion of the program, but is available to all our users. It is important to understand though that ANY items that you put into the Other Charges section of the fuel invoices do NOT compute into the price per gallon of the fuel grade. So in general this is NOT a feature that is used by most stations but is available. There might be a situation that some items invoiced in a fuel invoice should NOT be taken into account as a price per grade cost and therefore this feature can be used.

To create a new “Other Charge” just type the name in and then enter the amount. The next time you want to use this item, click on the refresh button and then find in the drop down list.

Mapping Other Charges to QuickBooks

S2k does NOT allow multi mapping of these other charges, there are only two mapping options available for fuel invoices apart from the fuel grades themselves. One is the Other Charges, items and the other is if the invoice line items do not total the actual invoice total, this is called Fuel Adjustment. You can rely on S2k to create the default mapping in Qb for you or map based on your requirements. FYI other charges goes to a stand expense account if not mapped and Fuel Adjustment goes to inventory COGS.

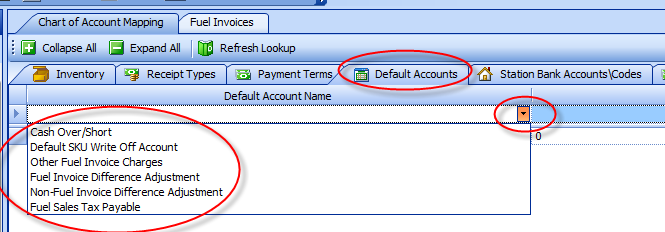

Go to Accounting/Chart of Account Mapping and Default Mapping:

AS can be seen above, you can setup a number of Default accounts for specific mapping in S2k. The ones you are interested in here are:

Other Fuel Invoices Charges – S2k will total all your Other Charges and put them here.

Fuel Invoice Difference Adjustment – S2k will put the invoice line total vs. total invoice value difference in here. This makes certain that invoice total in S2k and QB match exactly due to rounding issues.