Posting Take Inventory Invoices

S2k can post the Take Inventory Invoices created to QB. These are NOT handled in the usual way here is what happens:

1) If any type of write off or take inventory is required to be done we MUST use the correct TI VENDOR as the supplier on the invoice, you can merge the Write Off vendor they created as well to the Take Inventory Vendor.

2) To create a write off just create an invoice manually or via the handheld using that TI Vendor then post to S2k and then to QB. To view Take Inventory Adjustments you can only see them under posting menu under Non-Fuel Invoices to Post and the "Adjustments" bubble must be selected, one the UNposted invoices will appear. S2k will do the following:

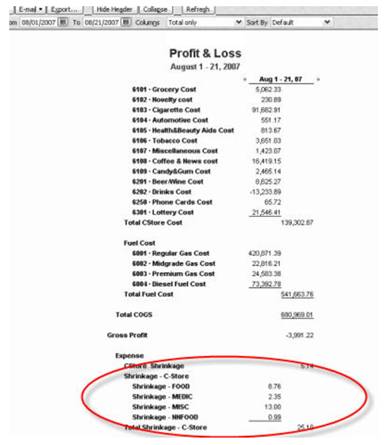

a) Will NOT create an invoice but a GL entry which will

credit or debit the expense accounts in QB that were affected by the write

off - each inventory dept will be totaled up and will be either negative or

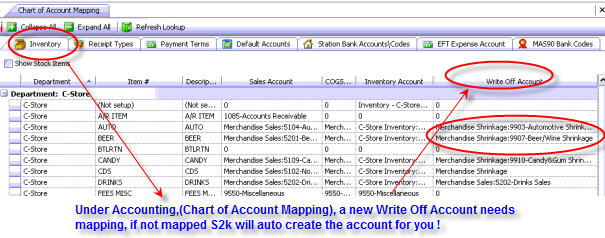

positive. You can map these if you want them to go to a specific expense account

or let S2k do it for you.

b) Send the other side of the transaction to an expense account as setup in the attached screen or automatically create an Expense account called "Inventory Adjustment"