TI Vendor Invoice Auto-Created

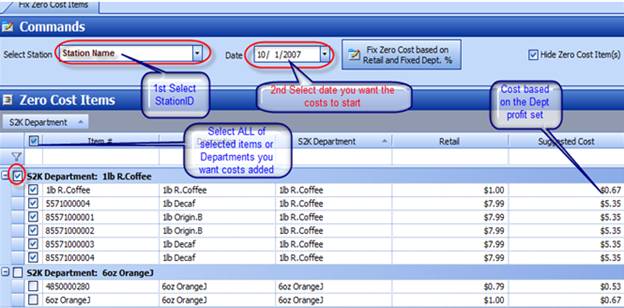

When you fix zero costs, the system will auto create an invoice on that date shown. A process screen shows you what is happening and once this is completed go to the non-Fuel invoices and find the invoice that was created.

The invoice created will show a quantity of one per UPC code, and this invoice should NOT be posted to QuickBooks as it is only used to establish a starting costs and has a total value of zero so will not be allowed to post to QB. AS soon as items are purchased the true invoices will start to merge into the system. Items with zero retail will obviously not have any cost attached to them.

The process to create and view the invoice can take upwards of 20 – 30 minutes depending upon how many items you have, and how far back you create the invoice. We suggest you create the invoice only in the last few days to make certain the process does not take too long.

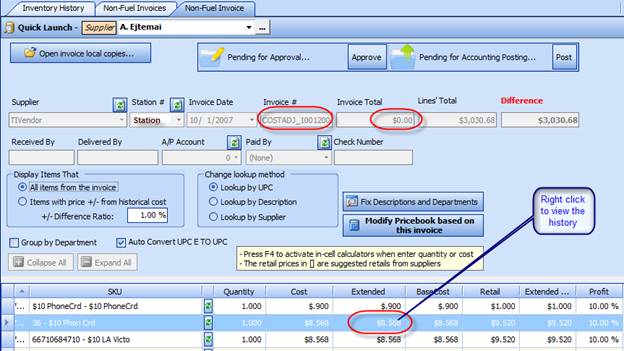

As can be seen the invoice above has some very specific details that are to be noted.

1) Any S2k adjustments that create invoices use a vendor called TIVendor

2) The invoice has a number of COSTADJ_XXX this shows that it is a cost adjustment invoice

3) The invoice value is $0.00 so it will not post to QB, it DOES add value to the S2k inventory but these are items you have never purchased so your itemized inventory is incorrect anyway.

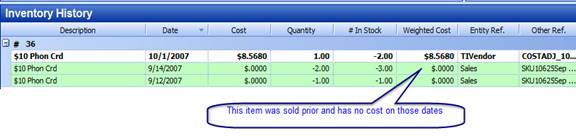

Right click on any line and View Item History and you will

now see costs added after the date of the invoice: